Whether you are an employer, or an employee, wages and salaries are the most vital aspects of your planning. Gross wages impact all employee payments, including tax deductions or other financial adjustments.

Here, we will delve into the world of gross wages, its calculations, components, types, importance, and policies that affect it. You’ll also learn how Payroll Software can streamline gross wage calculation processes.

Table of Contents

Understanding Gross Wages

Gross wages are the most scrutinized aspect of HR policies. Primarily because they are the first thing that the employers have to consider when planning a pay package. Also, when looking from a worker’s or employee’s perspective, gross wages are the first thing they think about at the start of the month.

So, what is a gross wage?

It is the total amount an existing employee or worker earns during a pay period (hourly, weekly, daily, monthly, or annually) from their employer.

Gross wage DOES NOT include any tax or insurance package (like healthcare) deductions.

It also DOES NOT include reimbursements to employees for company-related expenses personally like travel or entertainment expenses.

Importance of Understanding Gross Wages

Whether you are an employer or employee, understanding the ins and outs of gross wages is extremely important.

Firstly, as an employer, one must accurately calculate and record gross wages to adhere to labor laws. This ensures that minimum wage and overtime pay standards are met.

Also, proper gross wage calculation streamlines the payroll process. This pay forms the basis for computing taxes, benefits, and other paycheck withholdings.

Secondly, from an employee’s perspective, knowing gross wages helps to better manage finances, plan for expenditures, and make strategic financial choices. Also, they can gauge the full worth of their labor before any deduction is made.

One should also understand that gross wages are part of Accrued Payroll, which is the payment that a worker has already earned but yet to receive (the end or start of a month)

Both employers and employees should understand where gross wages will affect their bottom line (profits) or annual income, respectively.

Difference between salary and gross wages

A key difference that employers and employees need to be clear on is salary vs. gross wage.

When an employee is appointed for a role, the employer pays a mutually agreed amount to the employee every month (usually) against their appointment. In many countries, organizations decide the package calculated on an annual basis.

The package usually includes:

👉Base Pay

👉House Rent

👉Medical Allowance

👉Travel Allowance

👉Bonuses

👉Stock options or commissions (whichever is applicable)

👉Provident Fund (if applicable)

👉Gratuity (if applicable)

And other applicable components, as per rules and regulations.

Salaries mostly refer to payments made to white-collar job holders and executives. At times, the packages are called compensation packages.

In many countries, salaries are determined as part of the compensation and benefits plans against the HR budget, annually. However, upon negotiation with new hires, salaries vary from the originally planned budget. The payments are made either monthly (most common) or fortnightly.

In the US, companies’ compensation strategies set out the year-long compensation goals, and the compensation policies develop the individual compensation components as per state, local, and federal laws.

In contrast, wages are paid for work carried out hourly, daily, weekly, or per unit. The payment per period of work may be fixed but what a worker receives at the end of the day, week, or month varies.

In most cases, the wage earners are blue-collar workers in many countries.

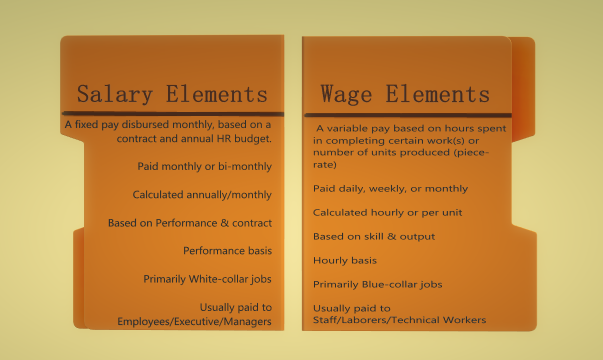

The following image summarizes the key differences of the two types of pay:

However, at times, the two are used interchangeably. This happens when wages are paid monthly, based on the total month’s work or time logged in.

What is the monthly gross wage?

When you pay or calculate the gross wage every month, for an hourly or daily-rated worker, it is called the monthly gross wage.

But see the determining factor: an hourly or daily-rated worker.

Wage, in general, refers to what an employer pays to a worker for service or work for a specified duration. The specified duration could be: hourly, daily, or weekly.

In many cases, a wage means the piece rate pay workers are paid for the number of units produced instead of the number of hours worked.

This is NOT the same as a monthly salary, which is the payment an employee or worker receives each month, as per contract or letter of employment.

A salaried worker receives a monthly payment – inclusive or exclusive of benefits – regardless of how many hours he/she worked or units of products he/she produced.

For instance, a waged worker WILL NOT receive any payment for time off or leave, regardless of the organization or local law. But a salaried employee will receive the pay if he is entitled to paid leave.

Hourly wage vs monthly wage: which is better?

The choice between paying at variable periods – like hourly, daily, or weekly – and fixed models like monthly or bi-monthly, depends on factors like:

🖋industry norms,

🖋job roles & responsibilities,

🖋Seniority level

🖋employee preferences, and

🖋economic conditions.

Across North America and Europe, the following Industries prefer monthly wages or payments

- Banks/finance,

- Technology, and

- Healthcare

- Education

Sectors such as retail, hospitality & tourism, and construction often opt for hourly wages to accommodate fluctuating work hours.

Employers availing of hourly wages offer flexibility and potential for overtime pay. However, this may create income variability and at times, fewer benefits.

On the other hand, salaried positions mean stable income along with benefits (usually) like health insurance and paid leave. But usually, employees do not receive overtime and lack working hour flexibility.

Gross Wage vs Net Wage

When comparing Gross Wage and Net Wage, both gross and net wages pertain to the money you rake in from putting in the hours at work. However, the key difference lies in the timing of deductions. Here, deductions include federal, state, and local income taxes, plus other cuts like health insurance premiums, garnishments, and retirement fund cash.

Gross wage is what the worker or employee earns before deductions are taken out. The gross wages are what the employee gets on paper, from the employer, not adjusting taxes or other deductions.

The net wage is your take-home salary after all the deductions are made. Basically, it is the money (or cash) that you receive each month or day (if you are an hourly-rated worker).

Gross Wages Formula & Calculation

Calculating gross wages varies from industry to industry, country to country, and above all, whether you’re an hourly or monthly salaried employee. There are also wage laws, like the FLSA in the USA, which companies need to consider.

Let’s look at a basic way to calculate the gross wages of an hourly-rated employee:

Hourly-rated Wage Calculations

Calculating gross wages is simple. Multiplying the hours worked by the hourly wage yields the result.

For instance, if the worker works 5 hours daily, and gets paid $10 per hour, he/she will receive $50 at the day end, if paid daily. If the worker is paid weekly, with 4 days of work, then the calculation would look like:

$10 x 5 hours x 4 days = $200 for the week.

One can calculate monthly gross wage as well with the same formula, given he/she works 5 hours for 4 days each week: $10 x 5 hours x 4 days x 4 weeks (common number of weeks in a month) = $800 for the month.

Net Pay or Wage Calculation:

As informed earlier, the “net pay” or “wage” is the amount the employee or worker takes home each day, week, or month, as per policy.

For the above calculation, if the $100,000 per annum gross salary consists of base pay, allowances, and other benefits like bonuses, provident funds, etc., then deducting applicable income taxes or other adjustments per week/month/year would get you the net wage or net salary. Let’s look at an example of a full-time employee US:

| Gross Monthly Wage ($20 x 8 hours x 5 day x 4 weeks) | $3200 |

| Federal Income Tax (13% of Monthly Wage) | ($415) |

| FICA (Social Security and Medicare) – 7.65% of Monthly Wage | ($245) |

| Health insurance contributions | ($400) |

| Total deductions from pay | ($1060) |

| Net pay | $2140 |

In Contrast: Gross Salary Calculations

Now, when it comes to salaries, as mentioned previously, how you determine it differs from wages.

In the US, the basic components of total annual compensation packages include:

✅Base pay

✅Variable pay

✅Bonuses

✅Incentives

✅Benefits

In other countries, these components are similar, with varying nomenclatures.

For instance, in India, the annual gross salary = basic/base salary/ + house rent allowance + other allowances + gratuity (if applicable) + provident fund (if applicable).

The other allowances can include conveyance, travel, medical, or other special allowances.

For instance, if your annual salary package is $100,00, the gross monthly salary would be $100,000 / 12 months = $8333 / month.

Calculating Gross Wage through Payroll Software

With the advent of automated processes, manual payroll processes are becoming slow, inefficient, and less effective. However, with the introduction of advanced payroll software, businesses are enjoying a multitude of benefits that are enhancing payroll management. And that includes gross wage calculations and recording.

Several types of payroll software boost and enhance the salary and wage administration of companies, helping streamline accurate and timely payments to all employees.

Some popular solutions available in the market are:

➡️BambooHR

➡️Gusto

You should understand which features to consider before purchasing payroll software as well as implementing them.

Benefits

Some benefits Payroll Software has are:

- The automated system speeds up the entire process with more efficiency and productivity

- These automate calculations, enhancing accuracy and reducing errors.

- You will stay updated with the latest legal requirements, avoiding compliance risks.

- Advanced systems ensure that critical payroll data remains protected from unauthorized and unwanted access.

Advanced payroll solutions help organizations streamline processes and enjoy hassle-free gross wages and net wage calculations.

Wrapping Up

Understanding gross wages thoroughly will help both employers minimize conflicts, ensure timely wage payments, avoid compliance pitfalls, and enhance overall organizational morale.

Employees also need to know about wages and the relevant calculations so that they receive those, correctly and promptly.

If you want to enrich your payroll knowledge further, then take a look at our articles on the YoSuite Blog and delve into prominent payroll topics and technologies.

Frequently Asked Questions

1. How do you calculate gross wages for unemployment in the USA?

Different territories have different ways of calculating gross wages for separated employees. In the US, if you are entitled to Unemployment Insurance (UI) benefits, you will receive 50% of your average weekly wage, up to $1033 per week, the maximum currently set by US laws.

2. How do you calculate gross wages for unemployment in Europe?

In Europe, for example, if you resided and worked in an EU country, Iceland, Liechtenstein, Norway, or Switzerland daily, or at least once a week, you have to register with the employment services and claim benefits in the country where you reside.

3. How are gross wages calculated if you work overtime?

In the US, the FLSA rules ensure that waged employees almost always get overtime pay, at least if they go over the standard 40 total hours per workweek.

Calculating overtime for a weekly payment would be Total weekly gross wage + (Hourly wage x Hours Worked x 1.5). The second part of the equation is overtime pay, which in most developed countries equals time and a half of regular working hours multiplied by hourly wage.

4. Calculating work overtime in the USA

For instance, if the worker, rated $10 per hour, worked 2 hours overtime for the week, then the total calculation for a week would equal: $10 x 8 hours x 5 days + [($10 x 2 x 1.5) = 30] = $350.

5. Are gross wages calculations the same across the world?

No, there are states in the US and other territories that have different overtime calculations. To know more about those, you can visit ILO’s wage calculations page.

6. How do you calculate the total gross income of an individual?

Gross income refers to the total income an earner earns before taxes and deductions. This type of income is the total income an individual earned, in a year, not limited to just wages or salary. It could be their side hustle income, revenue earned from business, or any other ‘legal’ income that is taxable by law.

7. How do you calculate the total net income of an individual?

The total net income is derived AFTER tax is deducted from total gross income.

Leave a Reply