HR professionals require various documents from new hires during recruitment and onboarding. Regardless of the size of the business, employers must go through major paperwork when hiring someone new. Not only for record keeping but more importantly for local, state, and federal legal compliance.

To help employers ensure a smooth and compliant document collections processes, a new hire paperwork checklist is a must! Let’s check out what paperwork US employers and other country recruiters need to manage. Along with how to create the right checklist for paperwork during onboarding.

Key Takeaways

➡️To create and maintain a paperwork checklist effectively, HR managers must list and collect all the forms that are required by state, local, and federal employment laws.

➡️Employers need to collect new hires’ signs on Offer Letter, Employment Contracts, Employee Handbooks, Government Forms, and other official documents within the first week of onboarding.

➡️A comprehensive new hire paperwork checklist must note all the documents needed for every stage of an employee onboarding, starting from recruitment.

➡️Using HR tools like Yosuite enhances HR’s paperwork process.

➡️Rules and regulations regarding employee paperwork vary across states and regions.

What is a New Hire Onboarding Checklist?

A new employee onboarding checklist mentions all the required documents and essential activities for new hires. This structured list covers all tasks and paperwork needed to help a new recruit understand their role and perform accordingly.

A new hire checklist will help you follow the right steps in providing the new hire a positive candidate experience. It will also help you avoid overlooking important details and staying compliant with local laws and policies.

At the end of the day, you should develop your onboarding process in such a way that it does justice to your hiring investments. And not dissatisfy new hires into leaving the company early.

What Paperwork is Needed for Effective Onboarding?

New hire paperwork includes a mix of legally required documents and internal forms. These help clarify expectations and protect both the employer and employee. Having all necessary paperwork ensures state and federal compliance. As well as meeting organization policies.

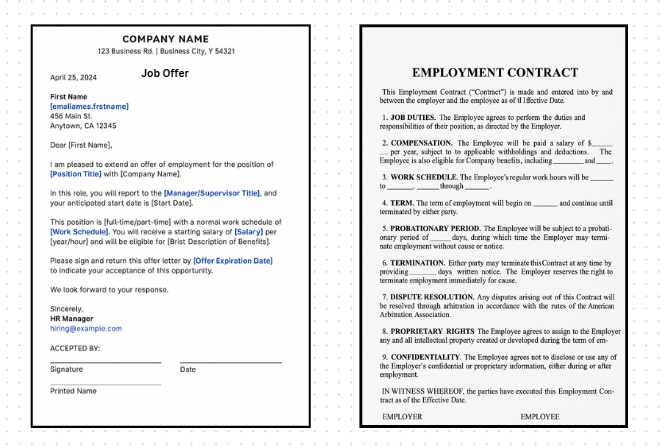

Job Offer Letter

Once a candidate is finalized for hiring, a Job Offer Letter is the first official document an employer sends out or hands to a new recruit. This letter, if accepted by the potential hire, works as a proof toward building a mutually binding employment. However, it is NOT the legal, official paper that confirms employment.

An offer letter includes:

- The name, contact details, address, and email of the potential hire and employer

- Specific role details, like start date, salary, work schedule and benefits.

- Company information (with the official letterhead it is created on)

- Undersigned name and position (usually the HR manager or Employer)

- Closing section for acceptance of the offer within a stipulated time

You would ideally give the letter to the new hire AFTER doing the background checks and medical tests (if needed).

Employment Contract

An employment contract is the legally binding agreement between the employer and the employee. It is more detailed than the Offer Letter, outlining terms and conditions like:

- Job duties

- working hours/days

- Salary, wages, and benefits,

- Duration of employment,

- Probation period (if any)

- Termination or resignation clauses

- Dispute resolution procedures

- Intellectual property matters

- Confidentiality clauses

- And other legal provisions as per local laws.

Quick Visual Comparison of Job Offer vs. Employment Contract is as follows:

In the US, “at-will” employment rules don’t legally require a written contract. Not for every position. But having one is recommended for clarity. It ensures both you and the employee are on the same page. And you can avoid employment complications and disputes that lead to high employee turnovers.

👉 Know which countries can legally release employees “At-will”

Employee Handbook

Usually during the orientation stage, employers hand out the employee handbook to new hires. This document details the company’s policies, rules, work ethics, and expectations.

Basic policies that your Employee Handbook should cover are

- Attendance policies

- dress code/work attire

- leave policies

- workplace conduct

- Code of ethics

- Harassment policies

- and other legal guidelines.

New hires should receive the handbook early, within the first day or week of employment. They should also sign an acknowledgment form indicating they have received it and will abide by its terms. This can act as an alternative to Employment Contract terms also.

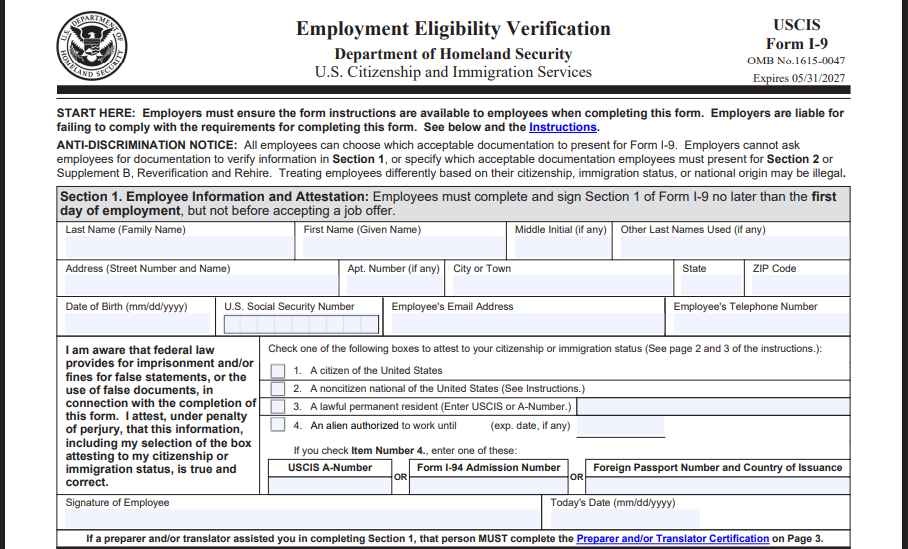

Employment Eligibility Verification

Every employer must verify a new hire’s legal authorization to work in the US, citizen or non-citizen. Form I-9, also known as Employment Eligibility Verification form, ensures that. You need to make sure the employee fills out this form (especially Section 1) by their first day of work.

The new hires must also submit identity and work authorization documents on their first day. These include a passport or driver’s license and Social Security card.

You should then thoroughly review the documents and complete Section 2 of the I-9 form within three business days of the employee’s joining. You will be required to retain each I-9 form for a period of at least 3 years from hire or 1 year after termination.

A similar work eligibility process exists in the UK, where a new employee provides an HMRC Starter Checklist (formerly form P46). That is, if they don’t have a recent P45 from a previous employer. A P45 is a document offboarded employees get from their employer during exit.

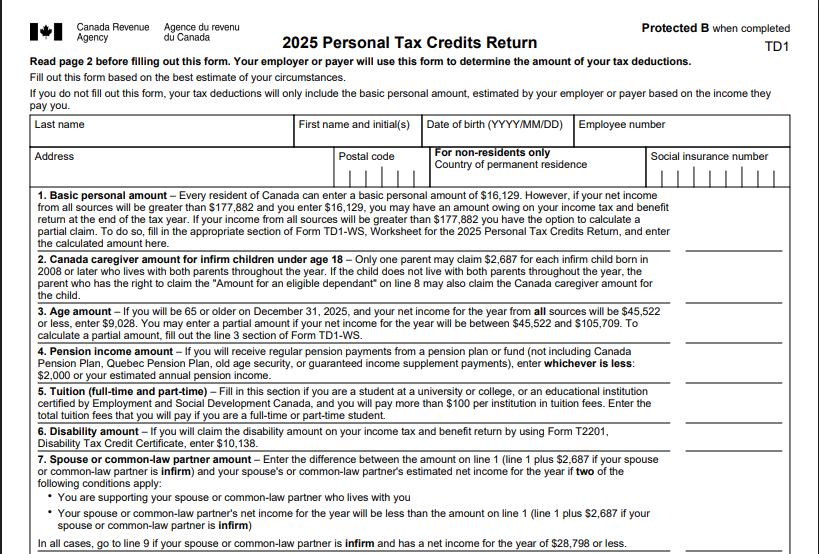

Employee’s Withholding Certificate

Along with the I-9 form, new hires need to complete the IRS Form W-4. This tells the employer how much federal income tax to withhold from an employee’s wages or salary. Employers must update the form whenever the tax situation changes. Many U.S. states have their own equivalent state tax withholding forms, besides the IRS W-4 form.

The employer uses the information on the W-4 to calculate proper tax withholding each pay period. Employers must keep W-4 forms on file for at least four years from the date of signing by the employee.

Canada’s TD1 Personal Tax Credits Return (one federal TD1 and one provincial TD1 form) is equivalent to the W-4 forms. Like the W-4, the TD1 accounts for personal tax credit amounts and other factors so that withholding is accurate from day one.

Emergency Contact Form

It’s also important to collect emergency contact information for every employee in case an urgent situation arises. This information will let you quickly reach a family member or guardian if the employee has an emergency medical issue.

The form should ask for:

- Name of contact person (one or two)

- Contact numbers

- Contact address

- Relation with employee

If you know an employee has a chronic disease or condition, then you should also include the details of the medical condition.

New Hire Reporting (PRWORA in USA)

Another key document that US companies must submit to the state authority is the New Hire Reporting Form. This comes from the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA). It’s a welfare reform law aimed in part at improving child support enforcement.

The law requires that each state establish a new hire registry. And employers must submit new recruit info by identifying information for each new hire. And that within 20 days of hiring.

The report includes details like

- The employer’s and employee’s names,

- Their respective addresses,

- Employee’s Social Security Number,

- Federal Employer ID Number

- And other relevant details

Many states allow this reporting to be done easily online or via electronic submission. While this isn’t a form the employee fills out, the HR department must gather the needed data and submit the report on time.

Bank Direct Deposit Forms

Most employers offer direct deposit of paychecks for convenience. To set this up, the new hire needs to authorize the company to deposit their pay into their bank account. A direct deposit authorization form will ask for the employee’s bank name, routing number, and account number

The employee signs to consent to electronic deposit. This form allows payroll managers to automatically and securely pay the employee without issuing paper checks. Typically, a voided check or a direct deposit verification from the bank is attached for accuracy. Keeping this form on file is important for company records and audit purposes.

Benefits Enrollment Forms

US companies that offer benefits along with salaries need to enroll with forms, online or offline. Employee benefits paperwork provides the terms, conditions, and choices for each benefit program.

For example, enrollment forms are common for health insurance plans. The employee needs to choose a medical plan option, list dependents to cover, and provide information needed by the insurer.

Other benefits that require forms include dental or vision insurance, life/disability insurance (beneficiary designation forms), and retirement plans. You can attach a ‘benefits brochure’ with the Employee Handbook. So that employees know what benefits they are entitled to. Or, you can list them in the employment contracts/agreements.

Health insurance enrollment form

When it comes to health insurance, new hires must complete a health insurance enrollment form to join the company’s medical insurance coverage plan. The form collects personal data needed by the insurance carrier.

Information included is:

- The employee’s name

- Social Security Number

- Date of birth

- Address

- Details of dependents (spouse, children), if any

Employers and employees can select the plans, like HMO or PPO and coverage tier like individual or family.

Retirement Contribution Forms

Employers can also offer a retirement savings plan, such as a 401(k) in the U.S. The 401(k) enrollment form typically lets the employee choose a contribution percentage or amount to deduct from their paycheck. And sometimes even receive an investment allocation for their contributions.

The form also includes a beneficiary designation for the account. Many companies provide an online portal for 401(k) enrollment, but paper or PDF forms are also common. Besides 401(k)s, employers have pension plan forms, profit-sharing plan info, or stock option agreements to sign.

In Australia, for instance, there is a 3-pillar Retirement Income System. It is based on Superannuation. In this method, employers contribute a percentage of an employee’s earnings into a superannuation fund, and this fund grows over time through investments.

Background Check (with reference to US Fair Credit Reporting Act)

You should definitely do background checks. Many employers conduct these immediately before onboarding. And some before finalizing the offer. Criminal record checks, employment history verification, and credit checks are some of the major background checks employers perform.

The U.S. Fair Credit Reporting Act (FCRA) legally requires a background check. But you must obtain a candidate’s written permission before running a background screening. This is done by a third-party agency.

Thus, a background check authorization form or consent document is often part of the new hire paperwork. This form clearly discloses that the company will be obtaining a consumer report (background report) and it must be a stand-alone document.

Non-disclosure Agreement (NDA)

A non-disclosure agreement (NDA) is a contract where the employee promises to keep the company’s confidential information secret. This document comes as an addition to the employment letter / contract.

Any employer can require a new hire to sign an NDA. But those doing business in industries with sensitive data or intellectual property use it more. A popular example is Kentucky Fried Chicken (KFC). The world-renowned fried chicken franchise puts extra emphasis on protecting its “secret spice mix” through strict NDAs.

By signing an NDA, the employee acknowledges that they will not share or misuse company secrets like client details, business strategies, trade secrets, etc. The NDA will also protect you legally, in case an ex-employee later shares protected information.

Non-Compete Agreement (NCA)

Some employers also ask new hires to sign a non-compete agreement. This paper restricts the employee from joining a competitor or starting a competing business for a certain period, after leaving the company.

This is done to protect the company’s competitive position and trade secrets. Some employers may also include a non-compete clause in the NDA or employment contract, instead of a separate document.

NCA specifies a duration like 9 months, 12 months, 2 years, etc post-employment to remain effective. Also, some employers require a geographic area within which the ex-employee cannot work for a direct competitor.

The use of NCAs has been quite controversial, with 5 US states banning the use of these completely. And the Federal Trade Commission (FTC) recently banned its use last year, but then revoked the rule last September. Even in Europe, NCAs are accepted ONLY if the cause of implementing it is extremely strong and the leaving employee receives around 30% to 100% of their salary. In fact, most countries don’t allow NCAs above 12 months.

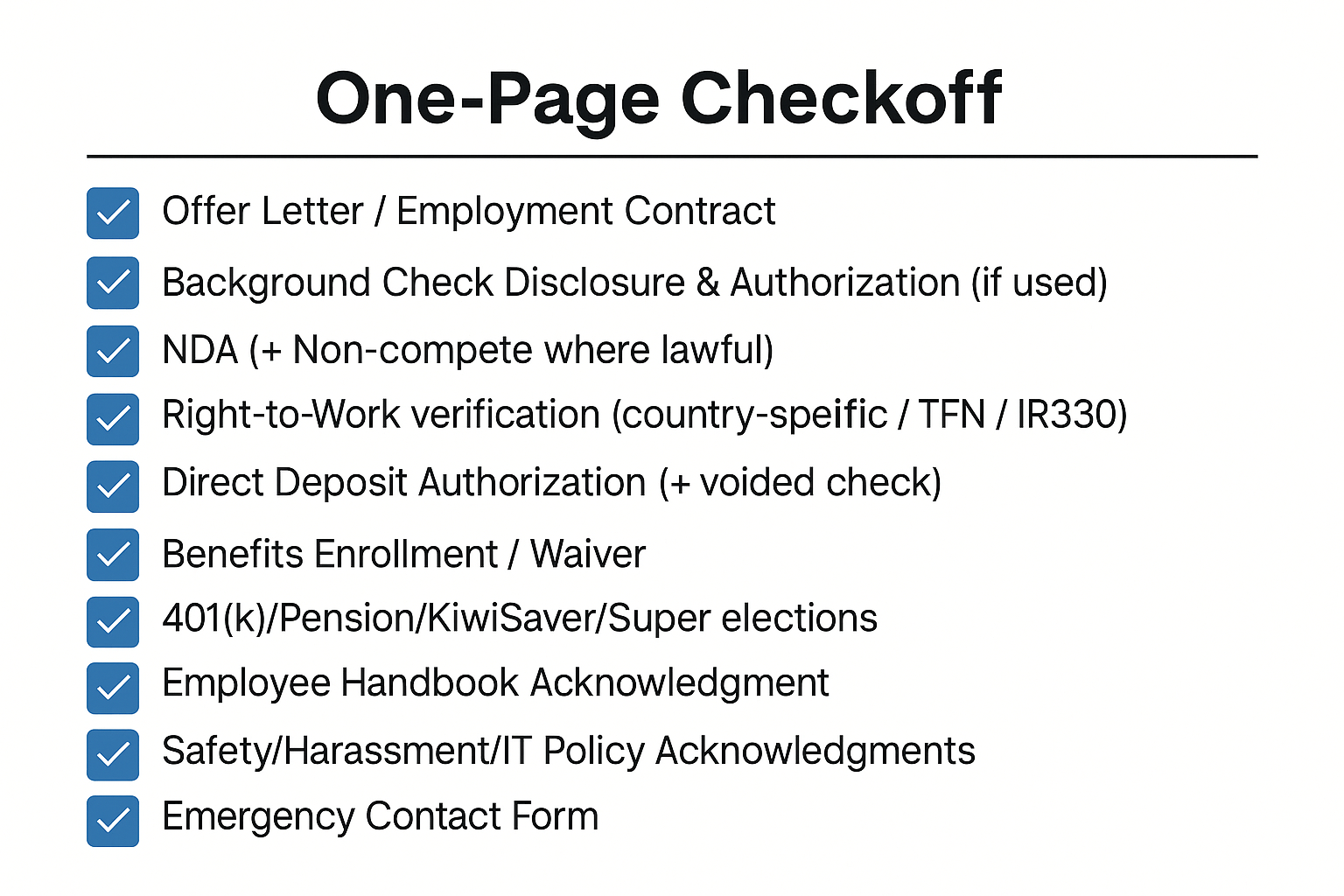

Creating a New Hire Paperwork Checklist

Tracking what needs to be performed for new hire onboarding begins during recruitment and can extend through an employee’s first several months. Different paperwork and tasks come into play at different stages of this timeline.

Below is a comprehensive checklist of the paperwork required for onboarding a new employee, beginning with the hiring or recruitment stage.

| Recruiting/Offer Stage (before acceptance) | |

| Offer Letter | |

| Employment Contract | |

| Background Check Disclosure & Authorization | |

| Drug Test Consent | |

| Reference Check Consent | |

| Non-Disclosure Agreement | |

| Non-Compete/Non-Solicit | |

| Required jurisdictional notices | |

| Pre-Boarding (after acceptance, before Day 1) | |

| Employee Profile & Personal Info | |

| Right-to-Work/Work Authorization Prep | |

| Tax/Payroll Starter Forms | |

| Benefits Enrollment Pack | |

| Equipment & Access Request | |

| 401(k) / Pension / KiwiSaver / Super enrollment or opt-out (by country) | |

| Day 1 (and first 3 business days) | |

| I-9 Completion & Document Inspection (US) | |

| Handbook Acknowledgment Signed | |

| At-Will Employment Acknowledgment (US, where applicable) | |

| Direct Deposit Verified | |

| Benefit Elections Confirmed | |

| Emergency Contact | |

| First 30 / 60 / 90 Days (orientation & retention) | |

| US New Hire Reporting (PRWORA) | |

| Fair Work Information Statement (Australia) | |

| 30-Day Check-In (survey + manager notes; attach to file) | |

| 60-Day Check-In (learning/compliance milestones documented) | |

| 90-Day Review (performance review form; confirm status change if probationary) | |

| Training Certificates (role/industry; file completions) | |

You can also create a quick checklist with the main required documents listed, depending on your region and industry.

Using an HR Software for Managing Paperwork

Creating and maintaining a new hire paperwork checklist is not everyone’s cup of tea. Even many HR professionals struggle to efficiently collect, sort, maintain, and track the onboarding paperwork.

And this is where you need robust HR document management software to help you out. An all-in-one HR platform like Yosuite vital features that smooth HR functions, along with document management.

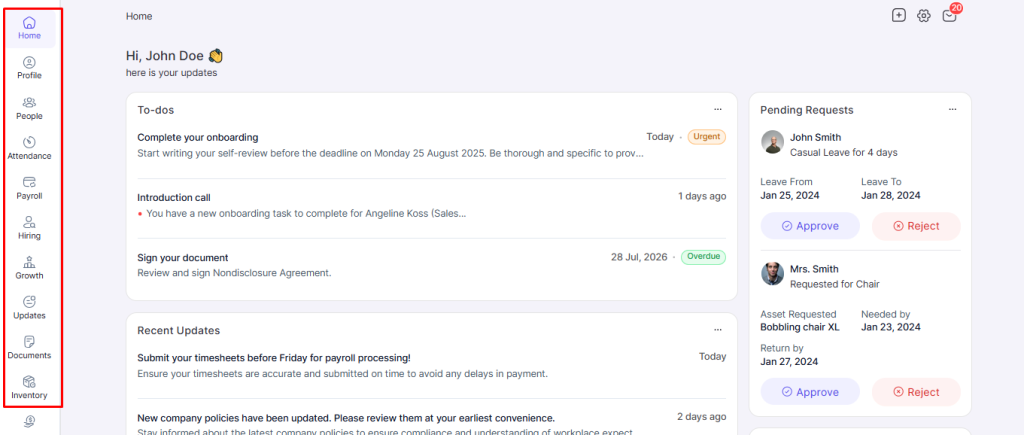

When you enter Yosuite, you will notice a detailed and intuitive dashboard. There, you will notice core HR modules to the left of your screen.

Using these modules, you can assign, upload, save, edit, and track new hire document management for effective onboarding.

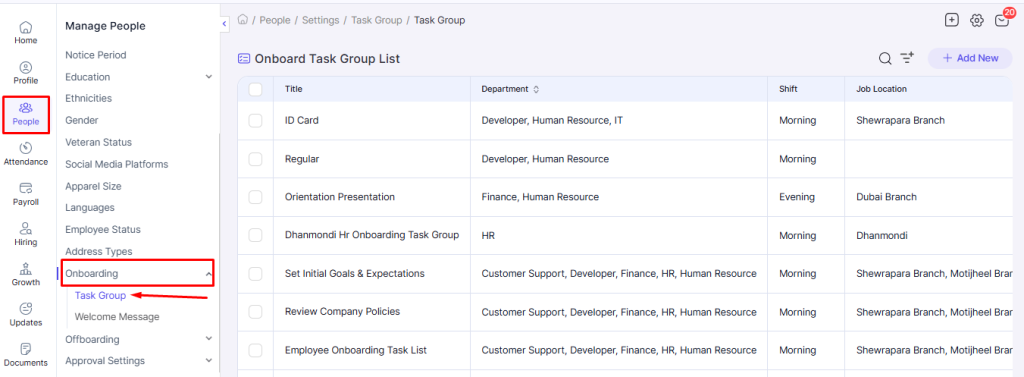

Say, we want to upload and track the signing of an I-9 form. To do that, first, navigate to People > Onboarding > Task Group. There, you will notice a list of existing tasks for onboarding new hires. Assigned to various departments across multiple office locations.

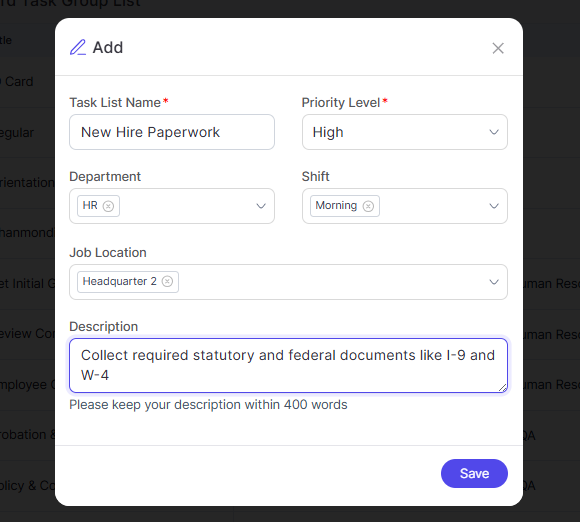

To the top right, click on the “Add New” button. A new window will pop up. You can enter the details of your task list, as shown below.

Enter the name of the task list, set the priority, select the department and shift, and choose the job location from the list. You can also add a description of the task list for record and clarification.

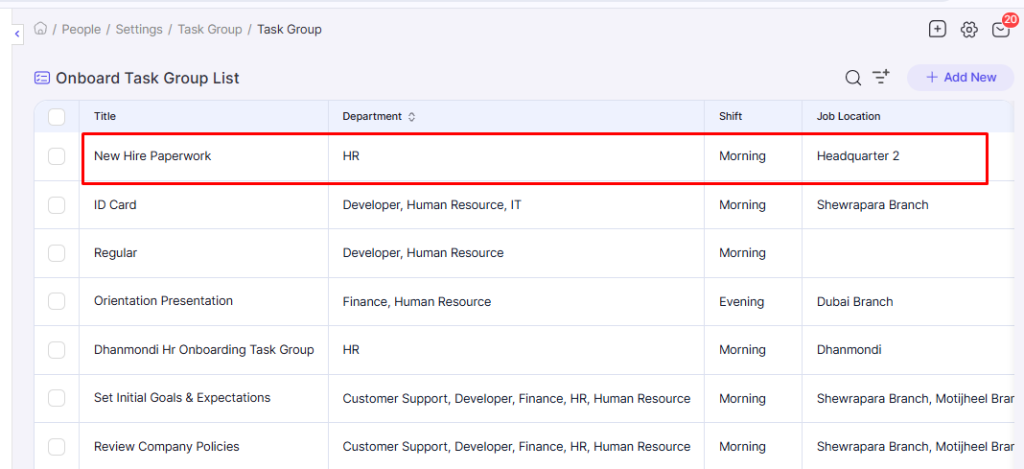

And then click on Save to see the new item added to the Task list on the Onboarding Task Group list.

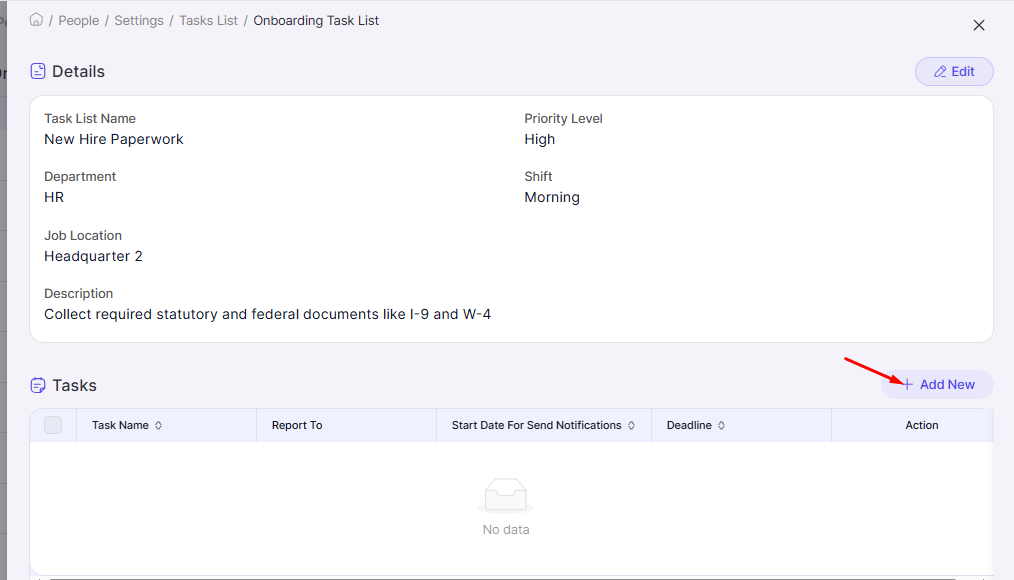

Now to work on the details of the task, simply click on the Title of the task list. You will notice a window slide in from the right of your screen.

To enter the task, we’ll select +Add New in the bottom half of the screen. Under the “Tasks” section.

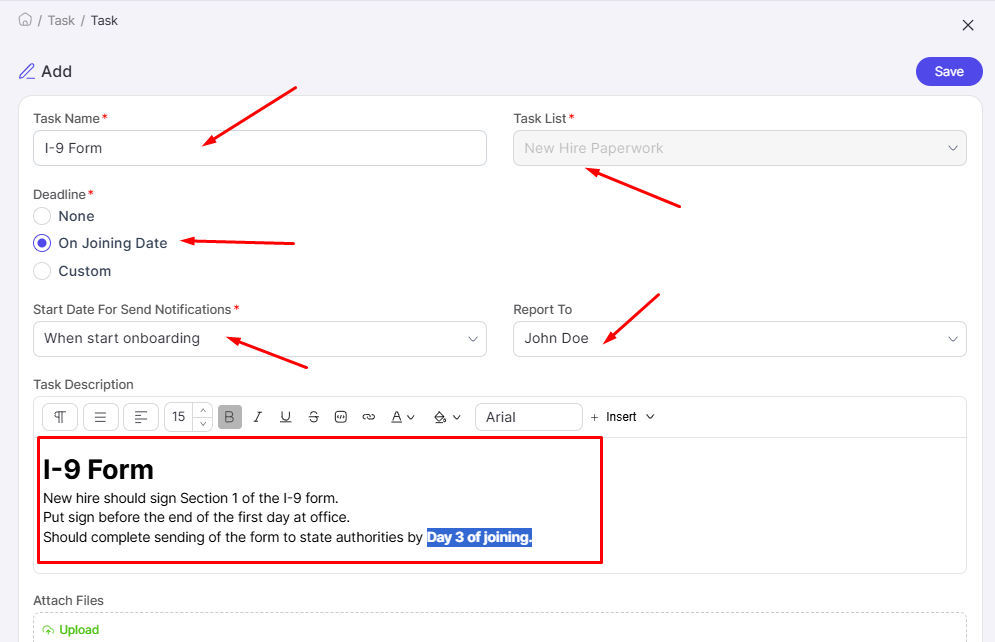

Here, you will add the details of the task. Including the task name, deadline, start date for notification, reporting authority of the assignment (Report To), and task description. Also, as there is a document involved, you will attach it via Attach File. In this case, we’ll attach the I-9 form.

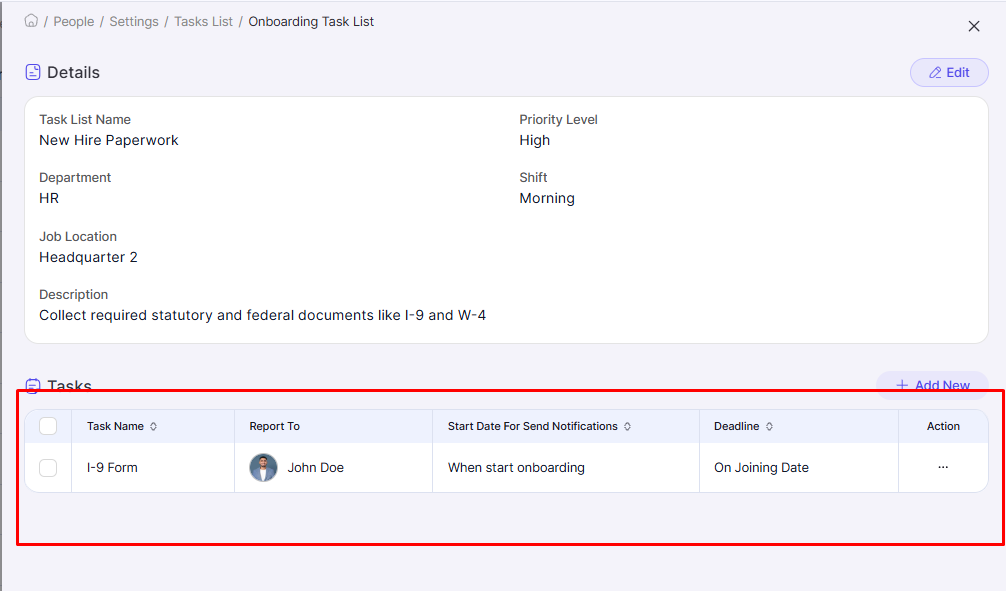

Save and return to the previous screen. You will notice the updated info added to the Task section.

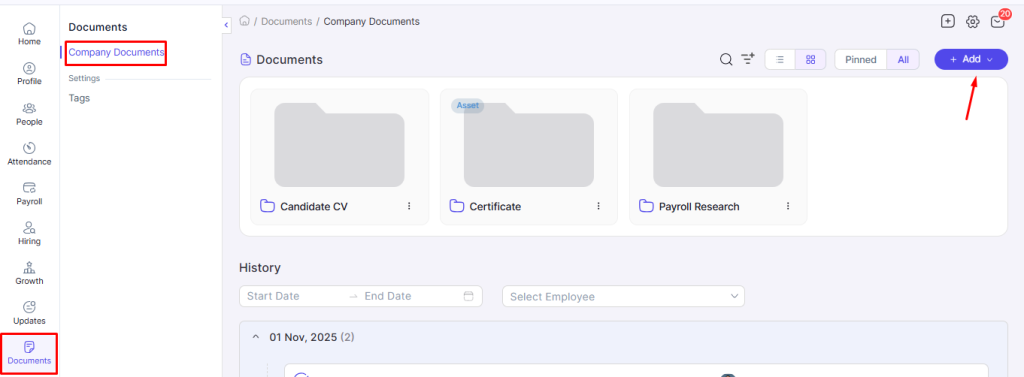

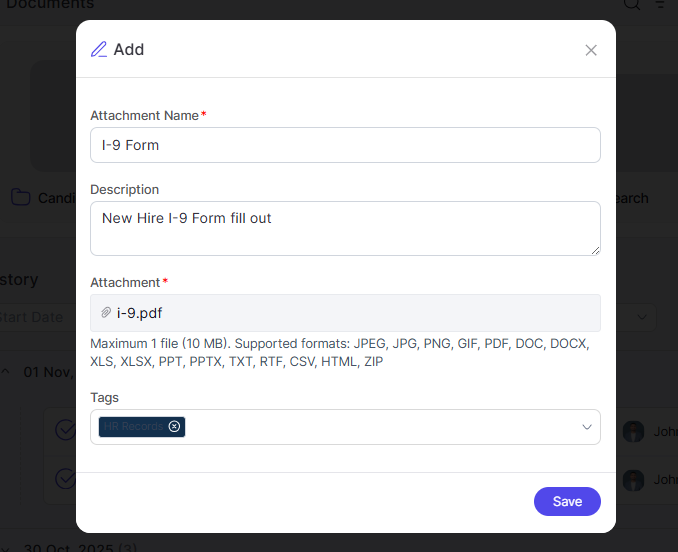

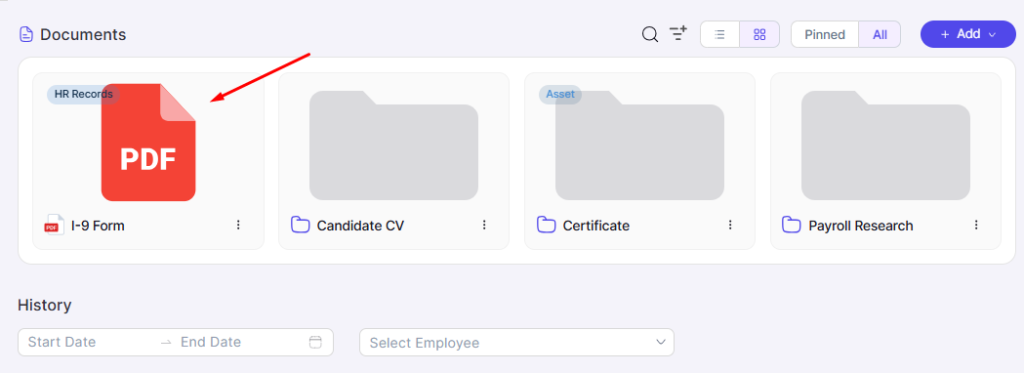

You can also directly upload, save, and track onboarding documents in the Documents Module. For that, go to Documents > Company Documents > Add.

There, you can simply name the document, add an attachment (document), add a needed description, and add a tag for relevant grouping/categorizing.

Click save and see it posted on the Documents page.

Do U.S. citizens need to complete Form I-9?

Can we complete I-9s remotely?

Do we need a signed handbook acknowledgment?

What should the offer letter include vs. the employment agreement?

What’s the best timing for paperwork for a new hire?

Summing Up

A well-crafted onboarding checklist and complete set of paperwork helps HR professionals stay compliant with local laws. And that new employees formally acknowledge the terms of their employment and company policies.

Equally important is expediting and enhancing the paperwork process. So that you can keep track of the documentation efficiently. Digital HR solutions like Yosuite create a smooth experience for both the employer and new hire. Helping in ensuring an effective onboarding process.

By utilizing HR software for paperless document management, you can save time, collect papers easily, organize docs accordingly, and reduce errors.

Get Early Access to Yosuite Today for Comprehensive HR Support!

Leave a Reply